Printed of the Honest Gogol

Specific higher education pupils has a rather hard time dealing with their costs. This new actually ever-expanding tuition costs, bills, or other expense can be sink the cash away from them. This might be most likely why much more about youngsters are increasingly embracing fund-both government and personal.

If you find yourself figuratively speaking to expend university fees costs are typical, think about student education loans to have cost of living? Does nothing also occur? Brand new short response is… yes. This article will improve college students throughout the financing for cost of living.

Might you Sign up for Student loans to own Bills?

Rather than the popular faith one to figuratively speaking developed only for educational intentions, they are utilised for personal use also. You need to know that educational costs dont are university fees charges by yourself. Discover a lot more expenditures directly about desire your own studies when you look at the an university. Just like the students, you are going to bear those can cost you during the one point or another in the schooling job. That’s where student education loans can be used.

So what can Student education loans Be studied For?

Student education loans were introduced to allow children to cover the college tuition. But stuff has altered since then. The newest U.S. Institution away from Studies allows children to make use of the amount borrowed additional regarding lead studies costs. Many acceptable city are housing and holiday accommodation. Additionally, individual loan providers is setting up the alternatives too.

Most of the school varies and you will establishes its own cost of attendance, which takes care of the price of you to definitely informative seasons. It is modified yearly. Whenever calculating the purchase price, colleges account for both towards-university and you may away from-university expenditures. The only-seasons pricing is even more to have in-county and you will away-of-condition people. Thus, the loan count varies and you may becomes paid properly.

When taking aside college loans, you’re literally borrowing currency to cover attendance costs, and therefore does not only defense university fees charge. They covers a combination of charges which include place and you will board, books, offers, transportation, or any other private expenses.

- University fees

- Education-associated charge

- Area and you can panel

- Property tools and you may supplies

- Items, market, off and on-university ingredients

- Guides, duplicates, gadgets

- Desktop computer or notebook getting college or university use

- Transportation fees

- Childcare costs (or no)

What Cannot Figuratively speaking Be studied To have

Now that you understand student loans can be used for paying out-of the even more expenditures, you will need to perhaps not score overly enthusiastic with this liberty. Always keep in mind why these is funds you happen to be required to pay-off.

You need to know what’s as part of the more expenditures group. Property, lodging, and you can utilities is things of utmost importance. However, clubbing, Netflix, and you can walking vacation commonly. Desired or perhaps not greet away, for individuals who put money into such items, then you are yes emptying the money you lent. And it doesn’t create any good to you (or even the financial or business) and may even property you in trouble after.

Without explicitly said, it’s better for many who abstain from these expenditures. After you manage quick spending money on things like courses and you will supplies, a study will need put. And you can depending on the seriousness of the student loan discipline, you can even deal with prosecution.

Individual Items

Not every student towards the university leads an equivalent private life and you can has a similar masters. Specific might have it finest, and others is generally top a difficult, difficult life-while likely to college. The us government understands so it and you will takes into account individual points that may or tend to apply to your capability to visit college or university and you may secure a studies.

Such as for example, when you find yourself an in-person-confronted person, the cost of attendance could well be increased to become people unique provider you can even require such as for example transportation costs, wheelchairs, and personal help sit in school.

The mortgage count will rely on whether you’re living into-campus, yourself, or other rental area. Off-university children generally speaking want a top amount.

Ways to use Federal Figuratively speaking to own Lifestyle Will set you back?

If you are considering borrowing from the bank currency to suit your college degree in the regulators getting covering your own cost of living, then you’ll must do specific pre-think. This is exactly a little more complicated than borrowing from the bank currency so you’re able to spend exclusively to suit your university fees charges then you simply must borrow the amount which is on college or university pamphlet.

Earliest, you really need to figure out what the expenses will in reality feel and you may just what matter you ought to ask for. You would also need to understand what sorts of financing you’ll be able to end up being trying to get as well as how you’re going to get money.

Subsidized Money

Paid student education loans are the safest financing you can purchase for your cost of living. Speaking of sponsored from the authorities and help you put off some of desire payments. Also, they supply independency within the payment words.

Unsubsidized Money

Unsubsidized financing are practically like backed government financing but are quicker beginner-friendly. These fund are reduced versatile and possess much more strict cost terms and conditions.

How to Use

To locate often backed otherwise unsubsidized money, while the a student, you would have to done and you can complete new 100 % free App to possess Government Pupil Assistance otherwise FAFSA form. Your college or university uses the latest FAFSA pointers in order to estimate your loved ones contribution to your studies.

The household sum count will be subtracted from your costs regarding attendance and https://carolinapaydayloans.org/ you will certainly be left toward amount borrowed you’re qualified to receive.

Once finishing the mandatory documentation, the loan amount will be paid to not you but to help you the school’s school funding workplace. Shortly after taking out brand new tuition costs, you will be given the surplus which you are able to after that explore getting your own living expenses.

Making use of Personal College loans to have Way of living Will cost you?

If you’re considered ineligible for a national financing, there is the option of taking out an exclusive financing out of a personal business. Because of it, you ought to fill out an application ask for an educatonal loan out-of an exclusive lender. this is processed within 24 hours and you’re getting a confirmation label regarding financial.

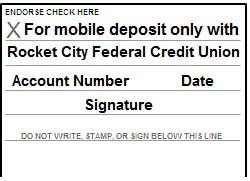

According to the guidance built-up, you’ll receive a personalized promote saying the amount you’re qualified to receive, interest levels, payment terminology, as well as other recommendations. Just after signing the latest agreement, extent was gone to live in your bank account for your requirements to utilize. All of this is typically done in less than a beneficial week’s time. The fees will be instantly started in line with the agreement. But remember that these types of loans are usually smaller flexible and much more stringent.

End

To summarize, student loans can be used to purchase bills and you may other things. Whenever you are federal loans are often best, you should know private money too.

After disbursement, make sure you make use of the individual otherwise federal education loan solely getting educational aim. Relieve your borrowing from the bank as much as possible and prevent extreme purchasing.

Leave a Reply